Estimate roth ira growth

At LACERS we value our retired members and strive to give you the best customer service. With a Roth IRA your contribution isnt tax-deductible the year you make it but your money can grow tax-free and your withdrawals are tax-free in retirement provided that certain conditions are met.

This Could Be The Perfect Stock For A Roth Ira Nyse O Seeking Alpha

Estimate a home loan with our Mortgage Calculator or get ahead of your Income Taxes with our Tax Calculators.

. An IRA is an account set up at a financial institution that allows an individual to save for retirement with tax-free growth or on a tax-deferred basis. If you are using your Roth IRA solely for growth strategies an annuity may not be the best. But sometimes early distributions are tax free and penalty free.

In 2022 the maximum amount you can contribute to a Roth IRA is 6000. Given the limited opportunities for these tax advantages opening a Roth IRA is a great way to become financially independent by retirement. The numerator is the amount converted.

A Roth IRA unlike a. Best places to roll over your 401k Best retirement plans for self-employed. That leaves plenty of room for growth because despite a rapid 58 increase in the second quarter Lemonades total in-force premium stands at just 458 million.

The most important tax implication to be aware of is the pro-rata rule. Which emphasizes earnings estimates and estimate revisions to find great stocks. 4 Eligibility to contribute to a Roth IRA does not depend on a retirement plan at work for you or your spouse.

A Roth IRA is a double-tax-advantaged retirement savings account that offers tax-free earnings growth and tax-free distributions. When deciding whether to place an annuity inside an IRA consider the goals you are trying to achieve. Since you derive the most benefit from tax-free growth by allowing your funds to earn interest over time contributing 500.

The economic growth rate is 43 214 trillion - 205 trillion 205 trillion. When you report a Roth IRA conversion on IRS Form 8606 see below there is a pro-rata calculation made. Best Roth IRA accounts.

Many financial experts estimate that you. Nevertheless we are always paying attention to the latest value growth and momentum. Why invest in an IRA.

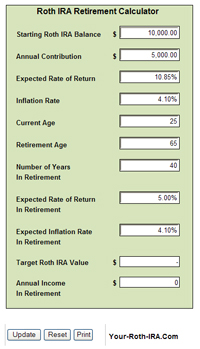

Use this free savings calculator to estimate your investment growth over time. The calculator will estimate the value of the Roth IRAs tax-free investment growth by comparing your projected Roth IRA account balance at retirement with the balance you would have if you used. The report on the secondary tickets market by Technavio expects the market size to increase at a CAGR of 787 and register an incremental growth of USD 224 billion between 2020 and 2025.

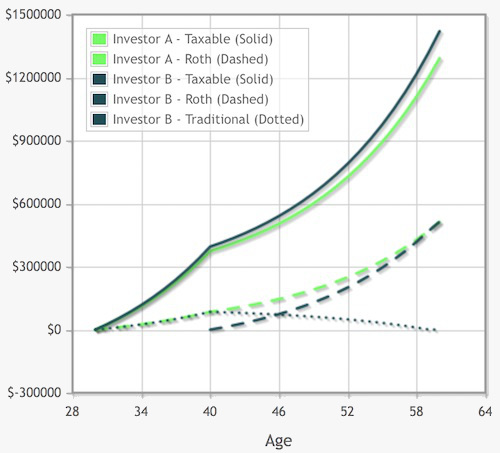

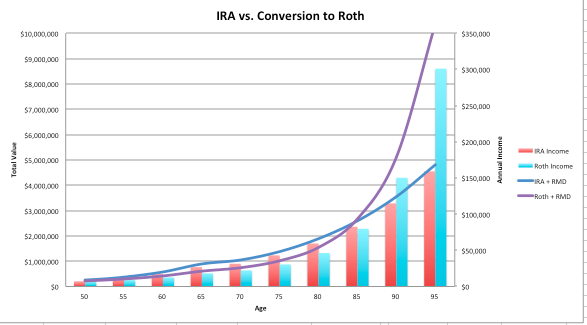

Compare IRAs get Roth conversion details and estimate Required Minimum Distributions RMDs. Different accounts available to you. Enjoy our Fast Free Financial Calculators.

Roth IRA - You make contributions with money youve already paid. Early withdrawals from an IRA trigger taxes and a 10 penalty. You may transfer your current IRA roll over your employer-sponsored IRA or roll over a deceased account holders Qualified Retirement Plan to a beneficiary IRA with Synchrony.

I would estimate that 90 of Backdoor Roth IRA screw-ups involve the investor having his or her conversion pro-rated. To do so please call one of our IRA Specialists at 1-866-226-5638. Find top resources and common links here or click below to view more.

Placing an annuity inside of a Roth IRA can lessen your risk while saving for retirement and generate tax-free lifetime income during retirement. The 3 main types of IRAs each have different advantages. With our IRA calculators you can determine potential tax implications calculate IRA growth and ultimately estimate how much you can save for.

On the other hand assume China had a GDP of 143 trillion for the current year and 139 trillion for the. Use our IRA calculators to get the IRA numbers you need.

Roth Ira Calculators

Traditional Ira Vs Roth Ira The Best Choice For Early Retirement

Should I Convert My Dividend Growth Ira To A Roth Ira Seeking Alpha

Roth Ira Calculators

Traditional Vs Roth Ira Calculator

Roth Ira For Kids Make Your Grandchildren Millionaires Retireguide

Roth Ira Calculators

Ira Calculator See What You Ll Have Saved Dqydj

Ira Kids Compound Interst Growth Of Roth Iras A Kid S Key To Future Wealth

Top 5 Best Roth Ira Calculators 2017 Ranking Conversion Contribution Growth Retirement Early Withdrawal Calculators Advisoryhq

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Traditional Vs Roth Ira Calculator

Top 5 Best Roth Ira Calculators 2017 Ranking Conversion Contribution Growth Retirement Early Withdrawal Calculators Advisoryhq

Roth Ira Calculators

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Systematic Partial Roth Conversions Recharacterizations